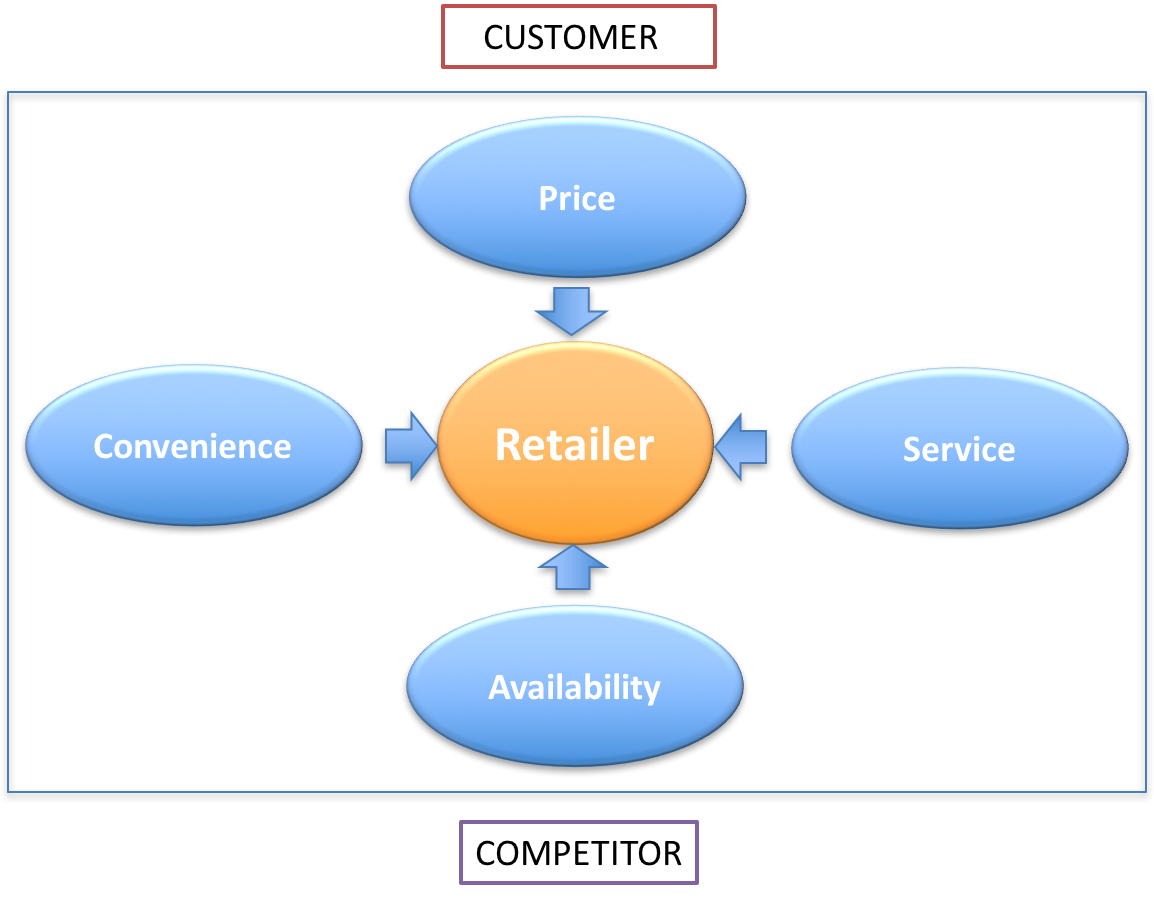

Retailers are challenged by many external competing forces

Price comparison, shopper convenience, product availability are all competing forces at play in the minds of both shoppers and retailers alike.

With apologies to Michael Porter, these forces are disruptive and ultimately drive big changes. Increasingly retailers are trying to reinvent themselves on how to balance these forces to ensure they win customers.

Today customers are equipped with product and price comparison knowledge that exceeds the average retailer or sales assistant. Armed with information customers are looking for retailers to match their expectations in across many of these areas.

Customers (and competitors) compare everything!

Price: Price comparison is now the norm. Consumers can be swayed by the smallest of price changes. However, retailers that add additional components such as convenience, availability and service to the mix may be able to add a percentage increase in price.

Even so, retailers have to use structured pricing data to understand their competitor’s prices and ensure they are still competitive in the market. Otherwise, any additional price premiums for service or convenience will not make any difference.

Availability & Convenience:

Is the product in stock? Consumers quickly compare retailers stock availability and delivery options. Convenience is also one of the major decision criteria, that retailers need to have on their strategic agenda. Marketplaces, such as Amazon are leading the way in this field and retailers are rushing to catch up.

Service: While service is sometimes perceived as an intangible, smart retailers are looking to make service a quantifiable element that has a cost and a value. Consumers know when a good service means more than just friendly sales staff. Consumers readily compare and discuss service with peers. Social media can quickly turn a poor service into a major escalation event.

Change can sometimes be difficult.

As with many industries, transforming from a legacy retail environment to a new operational model is not easy. History shows that companies fail when they don’t challenge themselves and look beyond their current cash cows. Nimbler more agile companies adopt new ways of thinking, embrace new technology, and have a clear vision for the future.

Incumbents, tend to rely on what they know best. It has served them well and provided revenues and profits for many years. In larger organisations, change is difficult and new ideas are sifted through by layers of management. Radical decisions are rarely made and progress is slow.

In the meantime, customers are drawn to new entrants or smaller players that are agile and address their needs.

Change needs vision and information.

Unfortunately, change often happens too late. It’s usually prompted by a decline in sales, falling profits or empty stores. Assuming retailers have the correct product mix today, they have to contend with strong competitors.

These competitors use data to understand market changes, retailer’s prices and consumer trends. Data trends and analysis are central to their success and decision making.

Unfortunately, the pace of change will not stop. Retailers will come under increasing pressure from the forces at play within both customers and competitors. By using price and competitive data, retailers may get the chance to counter those market forces, whether these are from customers or competitors.

However, they have to embrace change and do it quickly. Otherwise, it will be too late. Unfortunately for many, this is already the case.